In 2020, the global pandemic upended the way people interacted with each other, whether in business, shopping or day-to-day experiences. Products or services that seemed to be following a clear trajectory found it was no longer the case due to unpredictable consumer behavior. Everything research touched in 2020 changed due to COVID-19.

Not only did consumers change, but the way we did research changed. Video for qual took off this year, both for unmoderated video where people could self-record activities and conversations, and for moderated live video interviews, where you could talk to people one-on-one or in group sessions.

And of course 2020 was the year of tracking rapid consumer trends. We did our own tracking throughout the year to understand people’s changing feelings about everything from brand behavior to holiday spending. You did yours as well, in order to shore up your forecasts and understand where you thought things were going.

Looking Ahead to 2021

Because of the pandemic, consumer behavior changed, which caused many changes for businesses. Here are a few 2020 shifts that will continue into 2021:

- Focusing on new consumer values – Clear changes in consumers’ perception of health, safety and home.

- Investment in product experience and innovation to drive growth – Companies need to be ready and to anticipate what’s coming.

- Adoption of people-centric insights technology – You can’t just rely on big data now. You need deeper qual insights, and it all needs to work together.

- Alignment of business capabilities with consumer demand – Companies are looking at their core competencies to see what they can leverage.

- Reinvestment in brands and loyalty – As consumers try new products, companies are working to gain or maintain brand loyalty.

What does this mean for research pros as we head into 2021? Here are the top trends we predict for insights teams to reach their “new normal.”

Trend #1: Frequent, Quick Research Check-ins

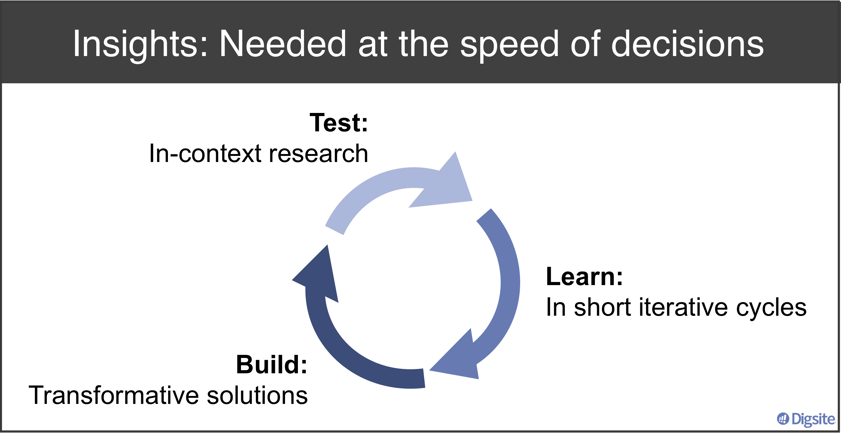

We have to move quickly in order to learn. Do you have that systemically built in to your organization? It needs to be a capability, not a one-off or emergency project. It needs to be built in to the DNA of your company: the ability to have ideas in the organization being built at the same time you’re conducting in-context research to help hone those ideas and learn in short, iterative cycles.

Case Study: Convenience Store

Problem: A convenience store chain had relied on research methods that took months to complete (e.g., focus groups and large-scale surveys). They needed a better, faster way to keep a pulse on their customers. Since consumer behavior was shifting so quickly, they needed to speed up their research and conduct it on a continuous cycle.

Solution: They shifted their research to a model where they could do shorter, quick projects that inform innovation efforts in a matter of days. It is now part of their ongoing innovation cycle, allowing them to adapt to a rapidly changing environment – responding midstream to the zigging and zagging of consumer behavior.

Trend #2: Agile Qual + Quant Research

Agile qual + quant allows you to do rapid research that gives you both the depth and validation you need. If you just have the option of qual or just have the option of quant, or if you have to go to two different vendors, it’s likely not going to be fast enough for you.

How agile qual + quant work together:

- Jobs to be done – uncover and size them

- Customer/shopper experience – explore and measure

- Product and positioning concepts – identify and iterate

- Ad and packaging solutions – validate and optimize

-

Innovation sprints – build/test/learn

Case study: Ready-made meals

Problem: This company was getting ready to launch a new line of ready-made meals and wanted to find out if the six new offerings were appealing and fit a consumer need. They were close to launching and had done limited research so needed to quickly drill deeper into product appeal and satisfaction for the new line of meal solutions.

Solution: They conducted a 90-person quant survey followed by six IHUTS for each product flavor. These groups received the product to try at home and provided detailed feedback on their usage experience. Then they conducted 12 follow-up live interviews to answer any remaining questions. All of this happened within a single study and over a matter of weeks, not months.

Trend #3: Refocusing on brand building

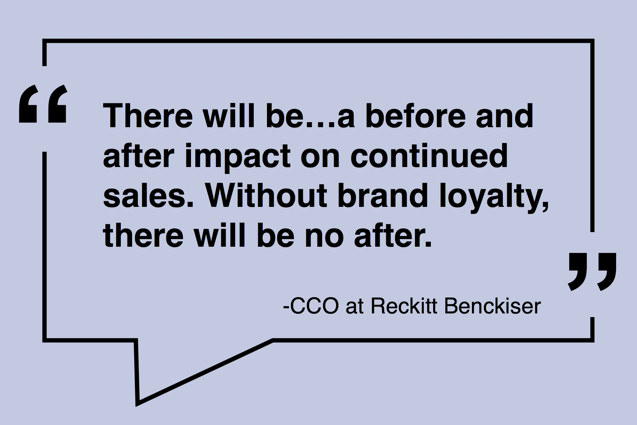

According to a recent study, 45% of people say COVID-19 has already changed their brand preferences. 62% expect permanent shifts.

If you benefited from brand switching during the pandemic, or if you’re a brand that didn’t benefit, you must now determine how to build up your brand and make it relevant to consumer behavior once a vaccine is available. While 2020 was in large part about pausing, for 2021 there’s a huge risk and opportunity cost with consumers’ potential to switch brands.

Case study: Deli meats

Problem: A food brand wanted to understand how to retain new consumers brought on during the pandemic.

Solution: They conducted a multi-day qual study with a targeted audience of switchers to understand consumer perceptions of their brand and product offerings. They found out what they could build on to keep these new customers, even when the customers’ regular products returned to the shelves.

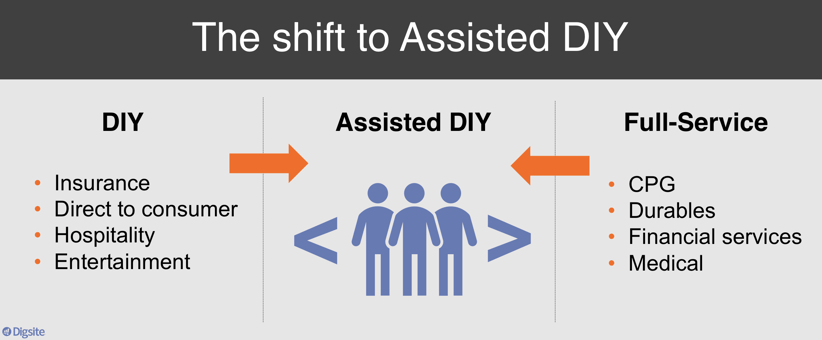

Trend #4: Assisted DIY Research

Assisted DIY is becoming a critical part of how we move forward. What is shifting, and why is it gaining momentum? A good example is Harry’s men’s products – their team was getting overwhelmed with the amount of DIY research and wanted to make efficient use of each person’s time. They also saw a need to do more complex research so were looking for ways to do what they could themselves and get topline consulting services when they needed it.

On the full-service side, a lot of organizations have smaller insights teams that worked closely with brands to identify problems and define research methods, but they weren’t actually fielding research themselves. For them, moving all the way to a DIY tool would be disruptive. Having assisted DIY is a good middle ground. If it’s too complex, they have help, without having to change vendors.

Case study: Insurance company

Problem: An insurance company wanted faster qualitative approaches to support internal marketing, CX and innovation sprints.

Solution: They adopted a research platform that allows them to recruit and conduct rapid DIY qual research, with the flexibility to provide add-on support in design, moderating and analysis when needed.

We have many unknowns ahead of us, but we can feel confident that our world has changed who we are and the way we think about and value our family and home. All of our businesses need to continue to understand that, share stories and focus on more than just big data. By delivering better and faster approaches to get to deeper human insights, companies can help build better solutions that create meaning for consumers.

To learn more about how to get started with agile research, check out our two-part series: Ready, Aim, Fire: A Guide to Agile Insights for Consumer Product Teams.

Part 1: Ready for a New Approach is the ultimate introduction to the foundations of agile research.

Part 2: Aim for Progress (Not Perfection) is a guide to get your company on-board and ready for action.