Budget planning plays a critical role in ensuring consumer insights are embedded into key initiatives and campaigns. Without enough money on hand, researchers have a harder time getting the data they need in time to make consumer driven decisions.

Typically, budgets for outside spending cover a mix of subscriptions to syndicated data, standardized tools for research and earmarks for ad hoc research that’s tied into key corporate initiatives. Insight teams effectiveness can be determined by examining how many key decisions they can influence, whether the research results were used to make stronger decisions, and the accuracy of those results in reflecting what would happen in market.

In addition to considering how many dollars and cents are available in the research budget—and managing that spend effectively—research teams also need consider how quickly they can deploy research dollars. After all, approaches that are slow and complex can significantly reduce the bandwidth of even the most productive team. At the same time, they decrease the likelihood a team can conduct research during predefined time constraints.

The good news is that there are new tactics and tools insights teams are using to get the answers they need to figure out the best way forward quickly and cost-effectively.

Let's look as some new approaches research teams are taking to increase their research effectiveness without drastically increasing their budget or overwhelming their teams.

How to Stretch Your Budget

In the digital age, it comes as no surprise that the number of ways research teams can collect data has increased. In large part, this is due to the emergence of new technologies that automate research approaches and support sophisticated analysis without requiring teams to hire outside consultants to help them filter through all the noise to find the signal.

What’s more, new research tools also make it easier for participants to contribute to research. In the past, getting involved typically required heading to some physical location to join an in-person focus group at a specific time. Today, willing research subjects can share feedback using their mobile phones—in many cases at their own convenience.

Beyond these shifts, agile principles have also played a significant role in the transformation of research. Instead of undertaking extensive research initiatives, today’s leading teams break down problems into much smaller pieces—conducting more frequent research initiatives while testing concepts, ideas, and features more granularly.

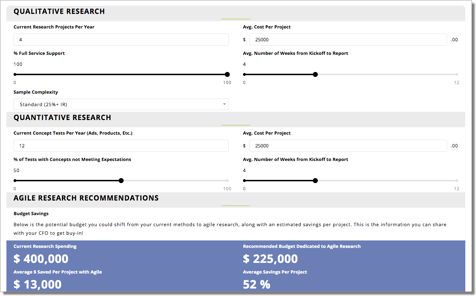

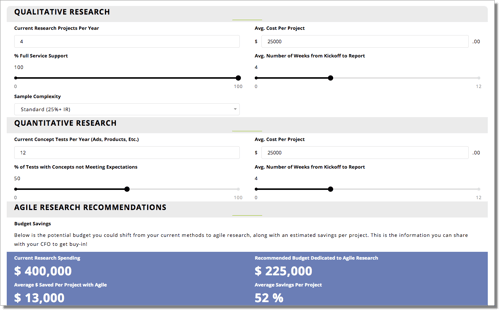

If you're interested in learning more about how agile research teams optimize their approach, budget, and resources try Digsite's Agile Research Calculator. This tool helps individuals and teams better understand how agile research planning is developed and the potential time and cost savings associated with this methodology.

The Agile Research Calculator

By now, you’re thinking that this sounds great and all. But you’re probably wondering how, specifically, teams are getting more research out of the same budget. Let’s take a look at five popular ways this is being done today.

1. Sprints vs. Deep Dives

The traditional stage-gate approach to research is giving way to the agile method. Instead of spending a lot of time and money getting a few answers that are tested in a "go/no go" fashion, the agile approach suggests that if you ask 10 highly targeted people about your idea, you'll learn more for less money than trying to quantify your results with 100 people. The goal is to develop empathy for their situations, drill down to find out why they feel the way they do and iterate quickly based on learning.

Overall, this makes it easier for organizations to make the optimal decisions; compared to the old way of doing things, research shifts from confirming a direction everyone later in the process to learning and getting smarter as we go.

Today’s leading companies use short intervals called sprints to get great insights earlier in the development process. With sprints, research teams don’t slow down development—they actually speed it up. It focuses consumer insights teams on informing the highest priority decisions each week. Instead of trying to test everything at once, they break problems down into smaller pieces that they can solve much more quickly.

This approach prevents teams from having to stop and wait for research results to come in before making the next move. At the same time, it also reduces the likelihood that projects are derailed by research that comes in too late.

Get more out of your budget by figuring out the best things to test and conducting rapid research to the find the answers you’re looking for—instead of large scale studies that cost money and waste time and might not help you find the data you need.

Making the move from deep dives to sprints starts with getting tools that can be deployed in hours or days instead of weeks. This is one place Digsite can be particularly helpful.

2. Standardized vs. Custom

Custom research has historically taken a lot more time and money to get done. Increasingly, new technologies are making it much easier to standardize an approach to research—helping organizations get better answers in less time.

Already, new standardized methods for high-frequency research—like concept testing and ad testing—have helped drive costs and timelines out of projects. Many of these tools offer automated reporting, including historically customized analysis such as MaxDiff.

The next-generation of standardized methods is emerging on the qualitative side, too. New technology offers standard discussion guide templates, automated reporting, and video analysis tools that put actionable reports in the hands of decision-makers much faster.

With the right standardized tools in place, research can be conducted much more cost-effectively—and a lot faster.

3. Ad Hoc vs. Ongoing

One of the ways teams have historically stretched their research budgets was by creating and maintaining customer communities they could tap into with any questions on a regular cadence.

While this approach continues to be effective, it can also cost a lot of money. Not only that, when you’re talking to the same people over and over again, how can you be sure that you’re getting the best answers?

Thanks to new tools, however, teams can spin up sprint research communities instantly from a shared panel of profiled consumers. As a result, they are able to get the on-demand research they need without the constraints of always talking to the same customers.

Creating the right combination of ongoing research groups and sprint communities can help organizations get rapid feedback while improving sample quality and maximizing the flexibility of when and how often consumers are tapped for research.

4. Do-It-Yourself vs. Full-Service

In the past, consumer products team relied on consultants to do all the heavy lifting while services organizations often conducted research in-house. Again, this approach worked but was expensive and time-consuming.

Thanks to new tools and automation, however, research teams can develop new skills while ensuring they still have consultants to rely on when they need them.

For example, agile research providers are offering a different agency relationship where customers don’t pay for things that can be automated or taken care of using new tools. Instead, they are just paying for services they need when they need them—much like software companies only pay for many AWS server as they need when using them.

What’s more, leading vendors provide training and support which helps in-house teams build their skills and deliver better research outcomes. Over time, teams become even more effective—positioned to get better results more efficiently, and at a lower price point.

5. Projects vs. Subscriptions

One of the biggest time-savers—and therefore cost-reducers—for research teams is moving from a project- to a subscription-based model for their research needs. Instead of having to get multiple bids from vendors in the weeks leading up to a campaign, consumer teams become much more nimble—to the point they can kick projects off the same day resources are deployed.

This new approach can be a game-changer—particularly for agile qualitative research. It gives teams access to qualitative samples that are pre-profiled, enabling teams to spin up unmoderated activities or schedule live video interviews in a matter of hours or days—not weeks.

If your team is still dealing with research engagements on a project-by-project basis, it may be time to start considering whether a subscription service can help you get more bang for your buck.

Getting Started with Budget Planning

At this point, you understand some of the easy ways you can extend your market research budget. But where do you begin?

Maximizing your research budget starts with making sure your team is aligned on major decisions. When you’re shifting some budget to fast iterative research conducted earlier in the development lifecycle, you need to make sure that your team engages stakeholders and gets everyone on board with the decision. Everyone needs to know why the organization’s approach to research is shifting.

For the best results, get your team thinking upfront about multiple small research iterations on each key initiative planned. Think of it as a proactive expectation whenever someone comes to you with a question. You’re not just going to test once.

Next, you’ll need to budget your research based on the internal resources you have at your disposal. In most cases, your situation will mimic one of these three models:

- Model 1 – Depending on your budget, you might be able to scale up your internal team and have them conduct the research in-house by subscribing to a research platform and using automation. In this scenario, your team needs to post questions, study responses, follow up, and take care of reporting responsibilities. It’s a big undertaking, but it works v organizations.

- Model 2 – If you don’t have enough FTEs on your team, you can subscribe to a research platform and use an on-demand consulting service that takes care of the heavy lifting for you. Here, your team would handle the oversight, but the consultancy would handle the nitty-gritty—things like setting up your communities and conducting research.

- Model 3 – Maybe you are able to hire an additional full-timer to manage the straightforward overnight iterations while relying on outside consulting services to handle the more complex initiatives. This hybrid approach is a great way to begin shifting to Sprints for some initiatives, while giving you flexibility to slowly expand your team as you prove out the success of your using more agile approaches.

Next, you’ll need to begin scoping back large-scale studies.

Historically, organizations would spend a lot of money up front on exploratory research and a lot of money on the backend for late-stage validation testing. As you begin implementing an agile approach to research, you need to look at where agile testing might eliminate the need for some of these larger studies.

Here, you might consider using existing syndicated tools and mining past research studies to create a starting point you can iterate upon. Otherwise, you may end up conducting research too early on in the process when issues haven’t been flushed out quite yet—burning your budget along the way.

As you begin examining your budget, look for places where quantitative validation makes sense. But also think about whether earlier qualitative sprints could reduce risk cumulatively and simplify or eliminate later testing requirements.

Finally, start shifting spending for quantitative vs. qualitative exploration.

As things stand today, 80% of market research spending is going to quantitative testing while 20% is going to qualitative. In the age of agile research, however, budgets are changing.

Companies are increasingly spending more on qualitative research throughout development to address issues earlier in the development process. At the same time, these organizations are using automated quantitative research tools to estimate demand and support the highest risk decisions at lower price points.

Proving the ROI of Your Research Budget

If you want to get the most value out of your budget, you need to make sure you have the right team and the right tools in place.

Beyond that, you need to state the case for agile persuasively. The easiest way to do that is trying to figure out the ROI of moving to a more cost-effective and faster form of research that helps your company make the best decisions. This ROI could be demonstrated in terms of costs per idea tested, opportunity cost of slower development costs, and reduced costs from complaints or poor performing ideas.

Once you have an model for determining ROI, take that to the finance team. Tell them that if the company makes the shift to agile, hires the right people, and puts the right tools in place, you could get X times as many ideas tested, while cutting the overall timeline for new launches by X%

Present a variation of this argument to your CFO, and your budget is very likely to be approved. Work hard to get great results during that first quarter or first year of funding, and chances are you’ll have even more budget to play with in the future.

Simply put, the ROI of optimizing your research budget speaks for itself. More data, better decisions, stronger products, and happier customers—all in a fraction of the time and for a fraction of the cost. What’s not to like?

Ready to get started exploring the cost and resource savings that Agile Research can provide for your organization? Check out our Agile Research Calculator.