Anyone can tell you there has been a recent explosion of new tools for online qualitative research. But which platforms are best used when? We break down five popular social and mobile tools so you can determine which would be most valuable to your research.

For more than 70 years, companies have used qualitative research to help figure out the precise products their customers demand. Traditionally, qualitative data was gained through focus groups and in-person interviews in what was widely considered to be an expensive and time-consuming process.

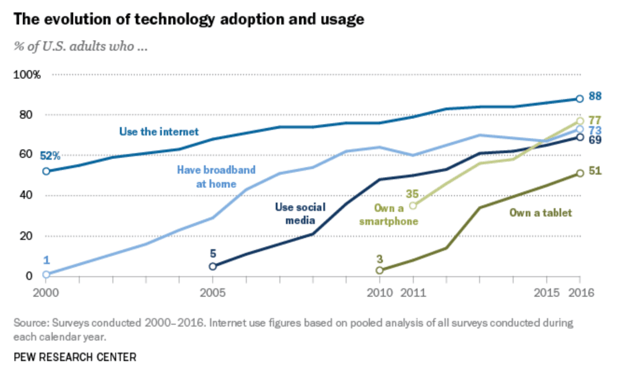

Thanks to the evolution of technology—and the emergence of social media and mobile in particular—the qualitative research industry has been disrupted. As mobile adoption increased, social media essentially converged with it. High-quality, mobile-friendly tools and apps emerged. Taken together, these developments have made online qualitative research that much stronger and more beneficial to organizations—not to mention more affordable.

Source: http://www.pewresearch.org/fact-tank/2017/01/12/evolution-of-technology/

Source: http://www.pewresearch.org/fact-tank/2017/01/12/evolution-of-technology/

Online qualitative research tools make it easier than ever for teams to crowdsource, conduct exploratory research, and receive meaningful consumer feedback. Not only can new platforms help them get this data quicker and less expensively, they also enable companies to make better decisions, as researchers are able to engage in collaborative conversations with consumers over a several-day period instead of talking with them once—as researchers did in the past. This is a significant change as companies can now learn the “why” and iterate within the same study.

Digsite CEO, Monika Wingate, has 20+ years experience as a market research professional. Hear her analysis on the rise of these online tools and their positive impact on the field of market research in this excerpt from the webinar, "5 Tools for Online Social and Mobile Research."

Between online communities, mobile qualitative software, and instant research tools, we understand there are enough social and mobile research platforms on the market to make your head spin. Choosing the wrong one could waste valuable time and money, and fail to provide the insights you are seeking.

Finding the right online qualitative approach can have a big impact on the speed and impact of your marketing research. If you partner with a qualitative research provider that meets your specific needs, you’ll get the data you need to make better decisions quickly—at a price you can afford.

Digsite recently published an in-depth examination of how to buy and assess online qualitative research providers. You can find that here:

[Download: How to Buy Online Qualitative Research and Assess Providers]

Below are five popular online and mobile research tools to help you determine which best suit your research needs.

-

Agile Insights Communities (example: Digsite.) Want quick consumer feedback as you build products, packages, advertisements, or websites? Digsite Sprints allow you to learn and iterate with consumers. Great for exploring customer experiences, optimizing concepts or building brand positioning and communication. Includes group or private discussions, image mark-up, voting, photo/video sharing, live video interviews, and open/closed ended survey questions. Get answers in as little as 1 day - for a fraction of the cost of focus groups. Digsite’s automation makes set up and management and final easy, leaving you to focus on learning and acting on research results.

Primary Use: Agile brand & product development and customer experience

Cost: Use a 1-Day Sprint for insights in just 24 hours, or opt for a Multi-Day Sprint or subscription for more ongoing or iterative research needs. Learn more about Digsite's pricing options.

-

Branded Communities (example: Recollective.) Allows expert moderator to create a custom branded community with activity-based workflow, screening and balancing, multimedia, full mobile access, and gamification, among other features. Researchers can conduct studies for as short as three days and 15 participants to a yearly, continuous site that supports thousands of participants. Subscriptions allow for unlimited studies, activities and discussions. Training and support are included with the platform.

Primary Use: Short term or ongoing research communities.

Cost: Pricing is tiered based on the duration and the number of participants.

-

Online Focus Group (example: Aha!) Activity-based online platforms allow for quick and easy branded research projects for expert moderators. Moderators can fully customize studies to fit their branding, or their client’s. Uses discussion guide templates and activities that make it easy to set up and launch a new study. Activities engage participants in traditional methods, such as open ended or multiple choice questions, as well as through more creative means, such as storytelling or collage building. The platform also works on mobile.

Primary Use: Online focus group

Cost: Study cost are based on number of activities and participants.

-

Mobile Interviews (example: Dscout.) Recruit your own participants to share quick feedback on real-world experiences, in-the-moment ideas via their smart phone. Consumers respond to your assignment with captioned images, videos, and answers to multiple choice or open-ended questions.

Primary Use: In-context research

Cost: Can be purchased on a per project basis or as a subscription. Recruiting and incentives are variable based on your needs.

-

Full-Service Qual-Quant (example: GutCheck.) Some full-service agencies use online research tools with instant recruiting to speed up the insights process. Moderators ask questions in an online forum can receive feedback from participants within a couple of days. They collect answers on an individual, one-on-one basis, or allow participants to answer asynchronously and view one another’s responses. Uses a full-service team to address your questions and concerns.

Primary Use: Quick Validation

Cost: Custom. No DIY options available.

There is no doubt that this boom in new platforms has further democratized market research, and revolutionized the industry. By partnering with the right vendor, your customers will be happier and your bottom line will be healthier.

To learn more about how you can benefit from agile research, check out our guide to Agile Research.