Rapid consumer behavior changes, shifting budgets and remote work have created new challenges for consumer insights pros. In this blog post, I share conversations with three industry leaders who discuss their top challenges and their plans for overcoming these challenges.

The impetus for these interviews was a study Digsite conducted in November 2020 with nearly 150 market researchers. The research indicated that insights pros need to balance high-quality, actionable insights at a rapid pace while dealing with limited resources and tight budgets. Essentially, the need for agile insights continues to accelerate, but teams are struggling to make faster decisions while ensuring quality sample, design, analysis and reporting. The three primary approaches being taken to address these challenges were finding new partners, finding new technology, and, unfortunately, working extra hours.

So I wanted to take this topic to some insights pros who are working to address these challenges and hear their stories firsthand. I found a cross-section of leaders in roles across shopper insights, R&D and market research.

Following are some excerpts that I hope you’ll find useful as you navigate the new year.

Panel participants

Irene Lin, Senior Manager, Consumer and Shopper Insights, Bonduelle

Anna Stoesz, Head of Marketing Research and Insights, Shutterfly

Amy Syhlman, Consumer Insights Senior Specialist R&D, Nestle

Q: How has market research changed at your organization, and what challenges has it created for you and your team?

Irene: A lot of the focus during COVID was understanding shifting consumer shopping behavior. It forced me to quickly shift our learning objectives for the year -- we had some foundational studies that were planned that we put on hold. Now that things are stabilizing a bit, I’m focusing on how to continue to monitor consumer change and decide which studies we want to move forward with that will have a near-term impact and which ones to hold off on.

Some of our solutions include leaning into more agile, quick turnaround studies, and we’re doing this by partnering with companies like Digsite and others that can help provide that agile approach.

Amy: One challenge has been getting people to be clear on the objective, why we’re using the tools we’re using, and making sure the tools are answering the questions we need to answer. Our solution has been to have a much more collaborative, less siloed effort, where we are all involved in the process. We try to communicate and be involved every step of the way. And we’ve challenged the way we work internally in general. Our linear internal process has had to change.

Anna: Research used to be a full-service environment. A few years ago I saw a rapid move to agile, which led to budget cuts and leaner teams. I used to primarily be a strategist, but now I’m both a strategist and an analyst. Wearing these two hats and moving between those two worlds has been a challenge – my team has had to pick up skills we didn’t have before. Another challenge: with new platforms comes the need to sharpen our tech skills and our gain experience with those platforms. It takes a while to get past the learning curve and become efficient.

Many companies use ongoing market research communities for recontacting participants, but repeatedly using the same pool of people has its drawbacks. For example, they can become biased by past studies on the same topic or they can include the wrong audience relative to your target. The Digsite iterative approach allows for fresh sample on-demand and even allows you to exclude people who participated in prior studies to ensure you’re getting new people.

Q: What are you doing differently in 2021, and what are you hoping to achieve?

Irene: We recently started bringing internal stakeholders along earlier in the process. Traditionally we would understand the objectives, disappear, and come back and present the results. The perception was that market research was needed but it was expensive and took a long time. We have been changing the perception and how we work. My recommendation is to have a core internal team and share a daily debrief about what’s coming in (while being careful not to draw conclusions). When they’re part of the process, they’re engaged the entire time, and it doesn’t feel like results and analysis are taking so long. Once you share out the findings, they’re receptive because it isn’t entirely foreign to them.

Anna: Just today, working with Digsite, we talked about learnings to date to see if we needed to course correct, and it was so helpful. Having that kind of flexibility to make changes is a priority. Now when looking at projects and partners, we make sure platforms are efficient and effective yet have the flexibility to jump in and course correct, because we work at the speed of retail. Our research needs to come along with us. Another priority this year is continuing to upscale the team and understand the latest and greatest technology that’s out there.

Amy: We are taking a look at our current toolkit and seeing where there are gaps so we can smartly go out and search for the tools we actually need. Bringing in external thinking is very important.

Q: How do you select a vendor or assess a technology?

Irene: It’s not easy, because there are so many types of methodologies. Part of our process is based on experience and referrals. During the past year, there were a lot of questions about consumers and how they were being impacted by COVID. My team was hungry for everything we could learn, and many research companies provided updates, webinars and information that I really appreciated and that also helped me understand the companies’ capabilities. Coming out of that, we found two new research partners. Engaging with and meeting the actual team helps you see if they can serve your research objectives.

Anna: I want a research partner, not a technology platform. I want them to understand how I think. If it’s a tool I’m not familiar with, I’m looking for expertise, best practices, and ideas for continuous improvement. I really want that strategic thought partner because I’m still learning as I bring that into my toolkit. Also, I’ll ask the vendor to help me bring to life what the final deliverable will be so I’m confident I’ll get what I need. You can really tell who can deliver on those things and who can’t.

What advice do you have for anyone looking to be more agile?

Anna: Connect with your network. Always be learning. Reserve budget to experiment if possible. Attend conferences, watch webinars, stay sharp.

Irene: Make sure every question counts. Focus on what needs to be known versus what is nice to know. Can we take action on it? Do we know the answer but just want to validate it again?

Amy: People expect a pass or fail situation. I explain that no matter what, we’re going to learn something – so we will maneuver and move forward regardless. Maintain positive energy about learning and taking small steps. Sharing success stories is really important.

Wrap-up

Ultimately, moving faster isn’t about doing what you’ve been doing faster. It’s doing things differently so you can get to faster development cycles, less rework and quality outcomes. Tighten your objectives and right-size your studies so you can learn and iterate as you go, and bring teams along for the ride so they’re part of the process all the way through.

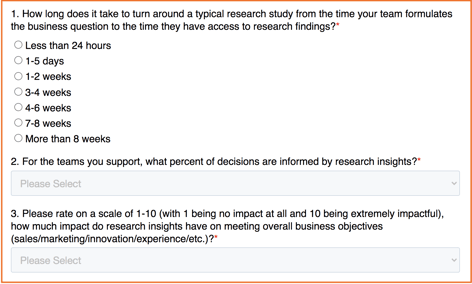

Curious about how your agility stacks up compared to others in the insights industry? We used our research study to develop a short self-assessment where you can learn your agility score and see your organization’s strengths and weaknesses relative to others in the industry. It also provides some tips and best practices.