The University of Wisconsin-Madison recently collaborated with Digsite to jump-start their MBA students’ hands-on learning with new product development. Students built and tested new product ideas by leveraging Digsite's integrated research platform for qualitative exploration and concept validation.

In our newest webinar, Digsite CEO Monika Rogers, UW-Madison Center for Brand and Product Management Director Page Moreau and three MBA student innovators held a thought-provoking discussion about how they approached the innovation process and their experiences leveraging consumer insights technology to build and test breakthrough ideas.

The agile principles applied in the new product development course showcased best practices in the industry. The students performed two phases of data collection, talking to real pet owners and coming up with real ideas based on the data that they gathered at various points in the process. Working with a Digsite research consultant, the students designed the activities and began collecting qualitative responses from consumers over the course of a couple days to generate a long list of new product ideas. The, 20 ideas were whittled down to four concepts that they further optimized with a larger test among pet owners.

Read on to learn about the student groups’ unique process and their final concept ideas.

UW-Madison MBA Student Panel:

Connie Cannizzaro

Amelie von Below

Thomas Meaney

Q: Talk us through what you saw in that Exploration phase of the project.

Thomas Meaney: The short answer is, we approached it wrong. We got into a room and started jumping straight into product ideas. Instead of trying to jump to the end, we needed to ground ourselves in that preliminary process and really listen to the consumer. It was intimidating at first having this open-ended sandbox, but when we started to zero in on getting that emotional connection it helped a lot.

Q: Tell us a little bit about Concept Validation and how you approached that.

Amelie: We started off with the results of our qualitative study to generate some concept ideas, narrowing those down to the four concepts that we were finally going to screen. Then, we carved out three sections of questions. In one, participants commented on what they liked and disliked about the concept and noted if they had questions about certain features. We asked about purchase intent and relative advantage. Then gave participants the chance to vote a thumbs up or thumbs down on certain features of the product. It was a really great way to get a lot of detail about the concepts, like what we could be improving in the concept going forward.

Q: How was your overall experience in the class integrating your learnings with the idea generation process? How did that holistically come together?

Connie: Based on the concepts that came out of the qual research, my team had a few more physical products and the other team had a few more app ideas, so I think the freedom that we had was really great. Nothing was quick-dry concrete—at each step of the way we were able to mold things into what we needed.

For the validation section, we were able to take all of the respondent feedback and mold that final product. We were even able to combine a few of the different concepts if we saw that they worked better together.

Q: What was the iterative process like and how did you approach it?

Amelie: We came in with some preconceived notions as to what pet owners would want because we had so many pet owners within our team. But this iterative approach really helped us narrow our focus in on the needs and problems that consumers were facing, which were a little different from what we were originally brainstorming.

It was so helpful because even if you have one really great round of research, you're still left making some assumptions as to what people really need. Having that second round allowed us to not just take those biases, but to really ask consumers what they meant by their comments.

Q: What was surprising to you in the study? What were some of the things that were really interesting?

Connie: We had our consumers go on Amazon or Chewy.com and fill a basket of what they would buy for their pets. It gave us great insight into what people are currently buying and what's on the market. We tried to see if there were commonalities and it also gave us a lot of feedback on what they aren’t buying.

It led us down a path where we asked ourselves “Are they not buying it because there's nothing on the market that fits the needs they have? Or, is it because they really don't need it and their willingness to pay for it is low?” Without an online research tool where we could go back and change items, we wouldn't have been able to get that feedback.

Q: How did the questions evolve as you were in qualitative iteration and then moving to validation?

Amelie: In the qual phase, it was so exploratory that we were really just trying to figure out a need that consumers are experiencing for their pets. In the validation phase, it was a lot more about evaluating the actual products, asking if it was a realistic product you could picture being on the market, if it’s unique or if you dislike it.

Exploring their needs gave us something to go off of when we were actually making our final presentations and selecting the product that we wanted to pursue. The whiteboard activity was a really, really great way to get into the audience’s minds and collect little tidbits of qualitative data. One of the most interesting parts to me about the research is that the words “qualitative” and “quantitative” weren’t set in stone. We did qualitative learning in both phases, we did some benchmarking in both phases and looked at the quant numbers throughout.

Q: What was your biggest insight from taking the class? What did you learn about new product development?

Thomas: For me, it was really interesting to see how easy it is to formalize creativity. You often think of creativity as this kind of magical thing that happens, but that doesn't work in a business setting. We need to move forward at a predictable pace and you've got to be creative whether you feel like it or not. Going through these short cycles, it was interesting how quickly things got sparked. It's not complicated but it's very, very effective.

Amelie: For me, it was surprising to see how many components there are to make a final product. When you start thinking about creating a concept there's the physical shape, the needed spelling, pricing, size, color, etc. There are so many pieces and we only had two phases of research. I could easily see us doing many more studies to get down to the finalized, detailed product.

Getting down into the details is just something you don't always get to do in Business School, so this was a really great chance to narrow in on those details and understand what the process would look like in real life. We spent about 30 minutes with 25 people in phase one and came out of it with a lot of rich feedback, so really that early-stage exploration didn’t have to be complicated with tons of people over many weeks. Just a little bit of interaction with the target consumer can give you a lot of new ideas pretty quickly. Not having to get an expensive focus group together and being able to have multiple touchpoints gives you a chance to breathe and iterate on your questions, too, so you're not trying to figure it all out in an hour. I really liked that we had that opportunity in the process and get a sense of the agile mindset.

Final Takeaways

Sometimes there’s a notion that we need to understand all the problems holistically before we develop solutions. We think we need to work on doing all sorts of strategy work before we figure out how to solve problems. What this experience demonstrated was how important it is to first focus on an initial set of problems to solve. After that, contemplate what the biggest question you have to learn is so you can build solutions against those problems much quicker. Consumer-driven feedback loops help you get to the right place and build a strategy by understanding the problem as you go.

Conducting research can be done in a number of ways. It doesn't have to be done in-person, and the students benefited a lot from the online engagement that they had in this project. We see that as a best practice for many organizations moving forward. There's so much more we can do with online interaction, whether that's social engagements, videos or asking people to mark things up on a whiteboard. Today, we have technology that enables teams to work hands-on and integrate with consumers through that process.

The Winning Ideas:

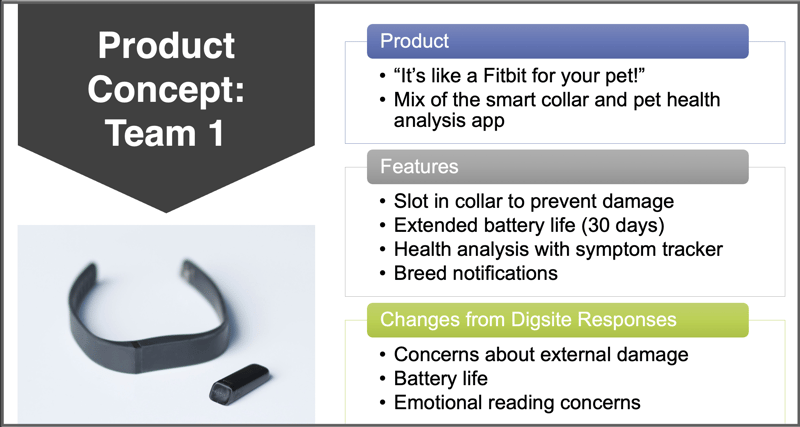

Group One Concept

Connie: This product concept was based on two of our initial concepts that went into the quantitative round: a smart collar and a pet health analysis app. Based on some of the feedback that we got from our consumers, a lot of them were commenting on their concerns with external damage and they wanted to make sure that it would be able to withstand the elements. So, I took that feedback and thought of a slot in the collar for this device to be protected, as well as the extended battery life.

With people having 50 different devices that are charged every day, a lot of pet owners don't want to have to worry about another device. We thought if it had a 30-day battery life, they could charge it when they took off their pet’s collar to put on flea or tick prevention medicine. That way, it would fit more into their current routine.

Group Two Concept

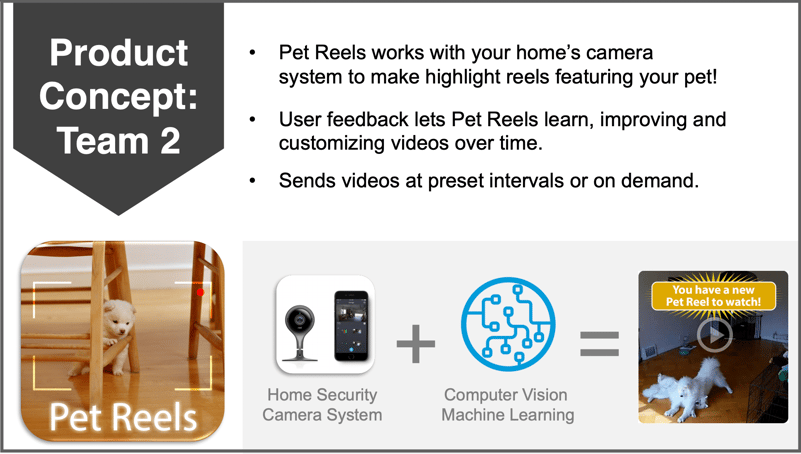

Thomas: There were four products that we set to phase two for quantitative feedback and one of them was an app that uses machine learning to gauge your dog's emotional state. You would use computer vision to look at your dog's face and body language to see if it was happy or sad or agitated. It got a really strong response. People were saying “I love this,” “I've never seen anything like it,” or “This would be so fun.” But then, when asked if they would actually buy this, the numbers were a lot softer.

One of the pieces of information we had gotten through the survey was that people were worried that they don't spend enough time with their pet. They were even more worried about when they have to return to in-person work, so we thought that we could combine those technologies and came up with Pet Reels.

Pet Reels could work as a program that integrates with your home security camera system to make little highlight reels of things your pet does during the day. Because we figured that people have these cameras in their house already, there would be hours and hours of footage. So, we use machine learning to look through the footage for you and you can provide feedback to say “Yes, I love this clip” so the machine learning will get better over time.

It was really interesting to see how quickly we were able to zero in on something like this after just a couple rounds of feedback.

To learn more about how to get started with agile research, check out our eBook: Ready, Aim, Fire: A Guide to Agile Insights for Consumer Product Teams.

Part 1: Ready for a New Approach is the ultimate introduction to get your company ready for action