The buying habits of moms are of critical importance for a $66 billion baby care industry. An online qualitative research study reveals the nuances of why mothers buy and how they buy. Their top priority: Quality that they can see -- in-person and off-line.

Transparency Market Research had predicted the global baby care market would reach $66.8 billion by 2017. But what will be the buying habits of moms? What influences and drives their decisions -- online and offline?

A Digsite online qualitative research study revealed the nuanced buying habits of mothers, including the important role quality plays in a purchase.

Want a quick copy of the report?

Research Logistics: A Unique Study to Discover Buying Nuances

Quantitative research tends to reveal broad-stroke trends among buying groups. We decided to use qualitative research to analyze and get a deeper understanding of the motivations behind the purchasing decisions of new mothers.

Over a period of 5 days, 26 community participants took part in an online Digsite Sprint. A Digsite Sprint is an on-demand market research study designed to provide in-depth insights from a targeted audience. Participants were recruited through social media based on their attitudes, interests and behaviors.

The Sprint included 4 activities, each of which comprised up to four tasks. The Activity Schedule was designed to produce qualitative results in the following areas:

Participant Breakdown:

● New Moms, 18-34

● Primary Shopper

● Children under 3 years of age

Objective 1: Current Experience With Brands

In the first activity, participants were asked to complete a Qualtrics survey within the Digsite platform. A group of popular brand logos were displayed, and participants were asked to rate the brands.

The logos were displayed in the following format. Participants moved a scoring bar under each logo to indicate familiarity, usage and liking of each brand. Gerber, Fisher-Price and Graco topped the list (honorable mentions brands are included in the downloaded report version).

Here are some participant verbatim comments regarding the brands:

“I love Luvs, Huggies wipes, BeechNut, Gerber, J&J baby shampoo oh the Lavender!! I love these because they have not let me down, I know they work and my babies love them. I have not purchased Honest yet, but have heard alot of good things.” – Melissa R

“I've learned my lesson when it came to choose price over quality. Especially with sippy cups and diapers. I purchased sippy cups that my children constantly took over the lids and they leaked I hated it. So now I buy the more expensive ones. For diapers I used to get the cheaper parents choice but they leaked overnight and caused rashes so then I went with huggies.” – Kristine M

Key Takeaway: Quality is Determined Through Personal Experience

A number of factors significantly influenced the moms’ feelings toward these brands, but the number one influencer was “quality.” And peer review alone were not a determinant of quality; the most reliable way for mothers to determine quality was to use the product themselves.

To read the other key takeaways, download the entire report here.

Objective 2: Brand Motivations

In Brand Motivations, we wanted to find out what attracted moms to particular brands and brand advertising. We asked participants to provide us with an ad, and then explain what they liked about that particular ad.

The motivations centered primarily on emotional appeal. Ads that really tied into the emotional bond between mothers and their children were the big winners. Humor also played into the results.

Take a look at an ad and the verbatim comment from a mom (more comments are available in the downloadable study report):

Key Takeaway: Price Absent From the Discussion

It’s all about quality for moms. Only once during the entire discussion was price mentioned with moms. It’s a factor, but moms are putting more emphasis on a quality product with both a strong brand heritage and an emotional pull.

To read the other key takeaways, download the entire report here.

Objective 3: Purchasing Behaviors

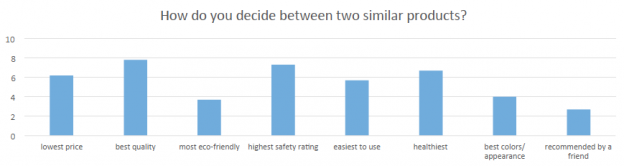

We could see the mothers’ motivations, but what happened to them when it was time to shop and actually buy a product? In the third part of the Digsite Sprint, we used a survey activity to gauge their current shopping habits, then followed-up with a discussion.

Assuming moms are focused on top brands, we asked what was the top motivation. The results show “best quality,” “highest safety rating” and “healthiest” as key product attributes.

Key Takeaway: Moms Shop Online for Necessities

Moms will shop online for “parenting overhead,” such as diapers, wipes, etc. But for new items - especially toys, car seats, etc. - they prefer to personally handle the item in the store.

While that sounds like a clear-cut victory for bricks-and-mortar, some moms will make the actual purchase online after checking out the item in-store. Others will purchase in-store (like the woman in the quote below), but use online to purchase the “parenting overhead.”

“I always buy at the store unless I'm ordering pacis or giT sets. I'd rather see the product I'm choosing for my baby. I even inspect it. Say we buy new pacis, I will pull on it to make sure it doesn't come apart easily since he always plays with his. And it's different buying for a child then me or my husband.” – Halley M

To read the other key takeaways, download the entire report here.

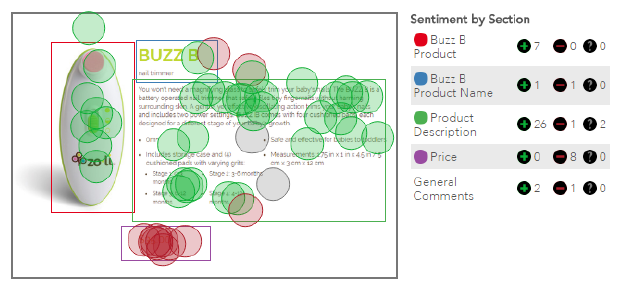

Objective 4: Side-by-Side Comparison

Participants showed their pragmatism in a side-by-side comparison of two tech products. In this activity, the products were displayed, and an online whiteboard tool allowed participants to leave positive or negative comments.

Moms’ strong belief in a trustworthy brand and emphasis on quality wasn’t as relevant in the purchase of these products. These products were considered “nice-to-have” and not essential. That being the case, price became the most important attribute. Note there were 0 pluses and 8 minuses by the price section.

Key Takeaway: What Makes a Product Essential

What made a product essential? If the products improved quality of life or provided entertainment or education, they suddenly became much more important to moms.

“Honestly, I probably wouldn't purchase either. We just don't spend that much on gadget items that aren't needed. Clippers work great for us, and I don't see myself actually using the paci sterilizer.” – Jennie H

Details Help Clarify the Big Picture

Throughout the study, the recurring theme for new moms was quality -- more specifically, tangible quality. Before a mom puts her baby in that car seat, she wants to feel it in her hands first.

We were surprised that “peer reviews” didn’t play a bigger role in moms’ decisions, although safety ratings were considered an important criteria. Nevertheless, purchasing a new product required an in-store shopping experience. It’s an important lesson for retailers.

And while quality was king, for non-essential products, price was a top factor.

The qualitative study fleshed out the nuances in these purchasing decisions, clarifying the broad-based assumptions we have about moms’ buying habits. It’s these little details that help marketers understand the big picture in the booming newborn baby market.

See Digsite in action and discover how it fits your needs-join us for an interactive demo webcast!