Without the right people responding to your questions, your customer research won’t yield actionable results. That’s why recruiting the right participants is so crucial to your online customer research. Here are some tips to ensure optimal recruiting.

We mentioned in our last post the importance of the “golden nuggets;” those verbatim quotes from customers that can springboard product development, branding efforts, or a UX website redesign.

Those nuggets will be fool’s gold if they’re not coming from the right people. Recruiting the right participants is critical - both among your current client base and new prospects. Ultimately, you want:

- The right person: A person who matches your ideal demographics and psychographics.

- The right person who actually is the right person: The real McCoy, not someone who signed up for a paid research project claiming to be the “right person” to get the money. (We’ll show you why that’s really not a problem with current technologies.)

- The right person who is articulate and a participative member of the community: A willing and eager contributor to the online discussion.

Two Types of Recruiting Pools

There are two basic recruiting pools you can tap. For simplicity sake, let’s break them into the people who “know you” and the people who don’t know you...yet!

1. The Recruiting Pool That Knows You

There are three general audiences that either know you or have a relationship with an organization that has a good relationship with you.

- Your own customers: An email or snail mail list you’ve built over time.

- Your social media following: Followers you’ve generated on Facebook, Twitter or other social media networks.

- Industry association or local groups: An email or snail mail list you have access to based on affiliation or partnership.

You can recruit from these audiences through two basic steps:

Step One: Survey (if customer list isn’t segmented). Most research tends to be specific, and your entire customer base may be too broad. If your customer list isn’t segmented, then conduct a survey to find the right targets.

Use an online survey, and keep the questions to a minimum. At the end of survey, offer an incentive to those qualifying to participate in the research project (we’ll discuss incentives at the end of this post).

Step Two: Screen. Direct them to your online research application for more in-depth screening. Be sure the online research application you’re using has this capability, as a manual screening process can be extremely time-consuming.

Digsite’s screening, for example, includes a series of questions, and then can automatically enter a participant into the study or reject them. (We’ll share an example below.)

2. The Recruiting Pool That Doesn’t Know You...Yet

You may also want to reach out to prospects who are unfamiliar with your product or service, but are the people who are your true target market. Because you have no contact information on this group, you need to pursue a different recruiting process.

Recruiting people for qualitative, online research projects is distinctly different than recruiting people for survey, or quantitative work. You will be looking for people who can express themselves online, and (as needed) be participative members of a group. It requires a different process.

Be sure the recruiting team you hire understands the difference, and the complexities involved with the project.

How do you find these types of participants?

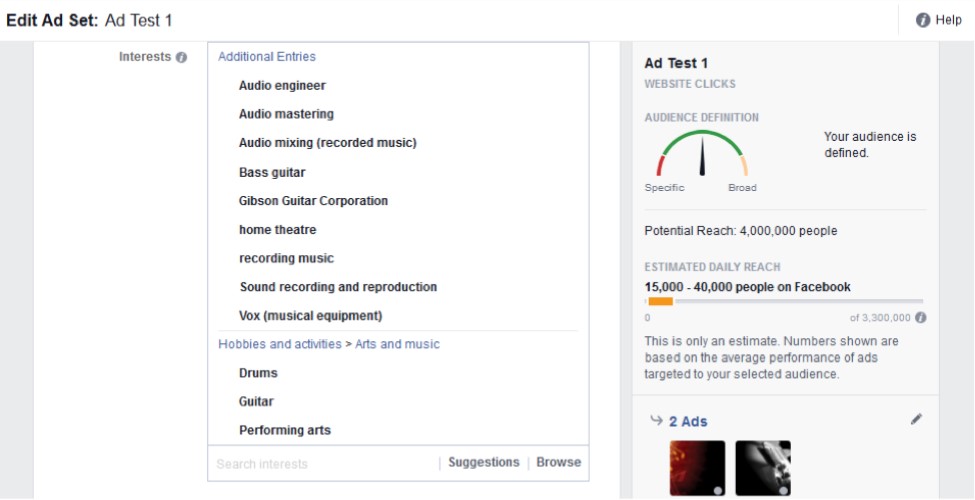

First, use social media to recruit people based on various criteria they have expressed over a period of time. Facebook, for example, gives us insights into various interests (see graphic below). Be forewarned: Social media recruiting can be tricky stuff. We have developed a unique system for recruiting for our clients, which we’re happy to discuss with you if you’re interested.

Second, once you narrow in on a target group, use a screener survey. A screener survey serves to further confirm that the potential recruit is 1) who they say they are and 2) the right fit for your research community.

For example, Digsite offers a screener survey tool that can be used to ask recruits specific questions based on ideal participant criteria. Some questions determine how articulate the participant will be during the project. Note the open-ended question:

.png)

Budgeting for Your Recruiting

Budgeting is always a tough subject for customer research. You want to provide an incentive that attracts the right people, but won’t break the bank in the process. Here are a couple of tips for budgeting:

- Deliver cash or a gift card specific to the target market’s interests or tastes

- Calibrate the size of your incentive to your target. Most qualitative research rewards tend to be in the $50-75 range. If you’re looking for a doctor, for example, you may have to spend $500[a][b] per participant. Your price point should match their hourly rate.

- Choose an incentive that can be delivered with minimal administrative time.

Although this doesn’t happen very often, there is the potential for people posing as an intended target to collect those larger incentives.

This seldom occurs with quantitative surveys, where incentives tend to be very small ($1-5). Qualitative research studies, however, tend to pay more, and so there is an increased chance of attracting someone trying to game the system for the reward.

We mention this not to scare you, but to make you aware of the possibility. It really doesn’t happen that often. When you use social media as a means to recruit new participants, it really doesn’t happen that often.

Why? Because many ads you run are based on the preferences people have already established, so it’s much more difficult for them to create a fake profile that matches your profile - or if they did, they would have had to have created it years ago to match your criteria. Not likely.

Taking the Next Step

We’ve touched on a few of the methods used for recruiting from two different pools. Remember, this can be a nuanced task. Be sure you understand the complexities. And be absolutely positive everyone involved knows the different techniques between recruiting for qualitative online research and quantitative.

To discover how Digsite can get you the right participants and insights you need, check out our Digsite Sprints Fact Sheet!