A unique marketing research approach has revealed the top challenges facing consumer product marketers. “Marketing strategy” and “Prioritization” are the most daunting challenges marketers face - and we’ve tapped into some expert insights to reveal what marketers can do to address the issues.

The research project used an online qualitative research methodology to generate insights from consumer product marketers. Called a “Digsite Sprint,” the methodology involved consumer goods marketers and market researchers responding to survey questions, concepts and graphics, and providing input over a period of 1-5 days.

Marketing Professionals Who Participated in This Study

Digsite conducted the research over a period of five days. Brand managers, marketing managers/directors, market researchers and category marketing managers in consumer product companies were recruited to participate.

.jpg)

These marketing managers are typically an extremely busy population, but Digsite’s virtual approach allowed them to participate in the research based on their schedule.

“With Digsite, the marketing managers could reply to questions and participate in online forums whenever they had time,” Boutelle said. “This flexibility is critical when you’re trying to research a busy population.”

Fifteen marketing managers participated in the study. Over the course of five days, they would log in to the online Digsite community and find the day’s activities waiting for them. Tasks included responding to surveys, marking up and commenting on concepts and graphics, and on occasion, responding to one-on-one questions directly from the Digsite moderator.

At the end of the five-day research period, the moderator used insights from the Digsite reports to draw actionable conclusions about the population.

Biggest Challenges for Marketing Consumer Goods

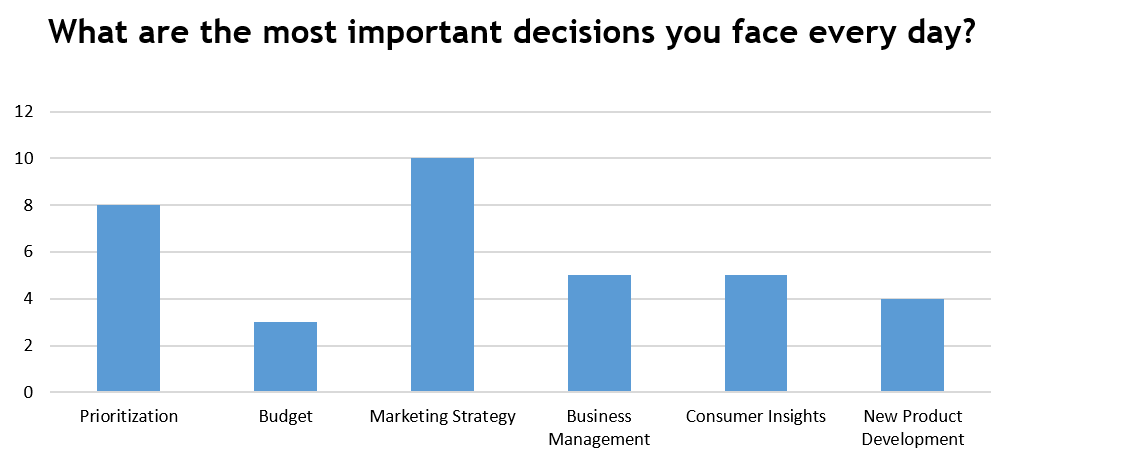

Managers were asked, “What are the important decisions that you face every day?” The open-ended responses were quantified using the triangulation methodology. The top two responses were “Marketing Strategy” and “Prioritization.”

Verbatim comments are generated as part of a Digsite report. For this question, responses included:

“Resource investment, how to spend my time, projects to prioritize, degree of depth of work to get to ‘good enough.’”

“Advising the marketing team on strategy for their brands.”

The focus on Consumer Product Marketing Strategy is hardly surprising. These are marketing professionals, after all. But strategy is becoming more closely related to discovering consumer feedback, and reacting to it. As Niraj Dawar and author of (@nirajdawar), Professor of Marketing at the Ivey Business School, and author of Tilt, noted in the Harvard Business Review:

“It’s no secret that in many industries today, upstream activities—such as sourcing, production, and logistics—are being commoditized or outsourced, while downstream activities aimed at reducing customers’ costs and risks are emerging as the drivers of value creation and sources of competitive advantage.”

Those “downstream activities” - what makes it easier for consumers to buy and reduces their risks - inevitably requires more research. How much research is required to get to “good enough” was a recurring theme among the respondents.

Prioritization of tasks was also extremely important. Many participants found their biggest challenge was prioritizing what to spend their time on, and how to effectively complete the tasks that were deemed most important.

David Edelman of McKinsey and Company’s (@davidedelman) post on “Hacking is the New Marketing,” he notes that “to get focus and momentum, you have to get something done quickly that will make it into market. And that’s a hack.”

Edelman’s post offers a more responsive approach to marketing, explaining that the need for speed requires a “more robust infrastructure” that can create “non-stop testing, learning and scaling.”

Approaches Used to Get Consumer Feedback

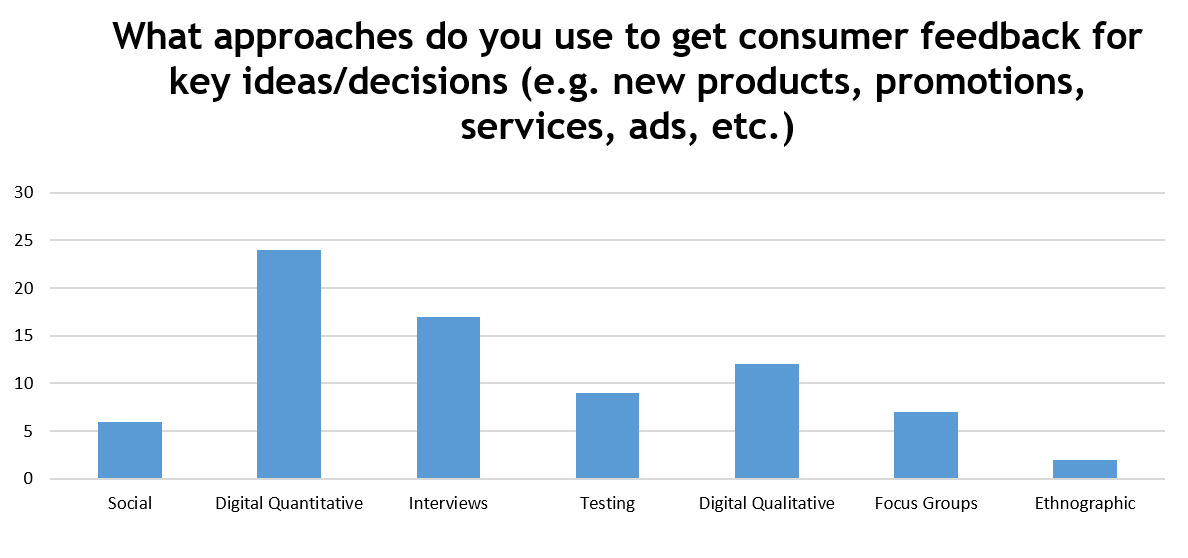

Digsite also asked the marketers what types of approaches they were using to get consumer feedback.

Topping the list were digital quantitative and interviews, although a wide range of tools tended to be used. Respondents’ comments included:

“I lean VERY heavily on the expertise of my CI partner linked to my brands. Usually online or in-person consumer groups, central location tests, in-home usage tests, attitudes.”

“Currently very limited. Customer interviews is most common form of feedback.”

Many respondents preferred to do some sort of direct interviews with clients, despite the high response from digital quantitative surveys.

Is Digital Quantitative Research Getting Risky?

The focus on digital quantitative could be risky, according to Market Research Guru Ray Poynter (@raypoynter). In a list of 2016 predictions, he notes:

“Market research surveys are increasingly alienating customers and citizens. As a consequence, response rates for commercial market research are fast reducing below 1%.” Poynter believes the surveys are “annoying” people and are limited in their ability to explain motivations and actions.

He believes more organizations are moving “away from traditional surveys, towards observation, big data, research communities, social media listening and other options.”

Leonard Murphy, Executive Editor and Producer for GreenBook and Senior Partner with Gen2 Advisors, added that online qualitative research is being used to fill in the gaps with online quantitative, and may actually lead to a “Golden Age of qualitative research.”

How Often Do You Get Consumer Feedback? How Often Do You Need it?

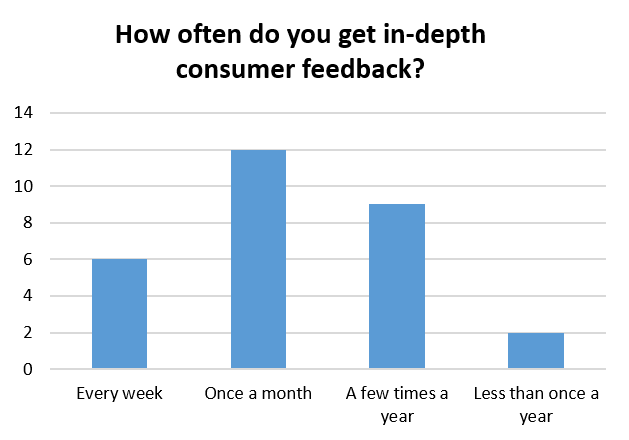

We next asked about frequency, and how often marketing managers reach out for consumer insights. Monthly was the top response, followed by a few times a year.

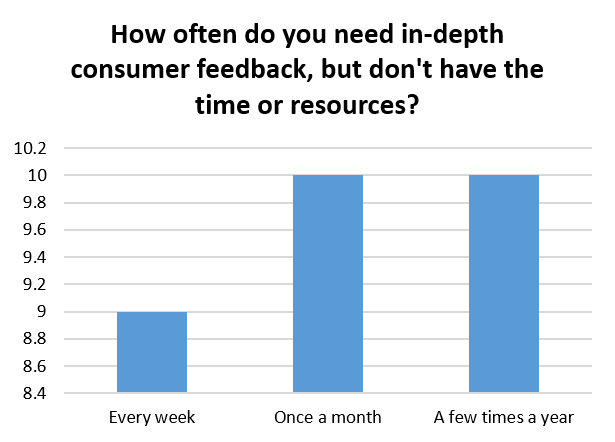

We then asked how often do marketers need in-depth feedback, and there were a wide range of responses. We can see that marketers feel strongly about reaching out to consumers frequently for in-depth feedback, even if they might not be engaging in the practice at the moment.

What Types of Consumer Insights Will You Budget For?

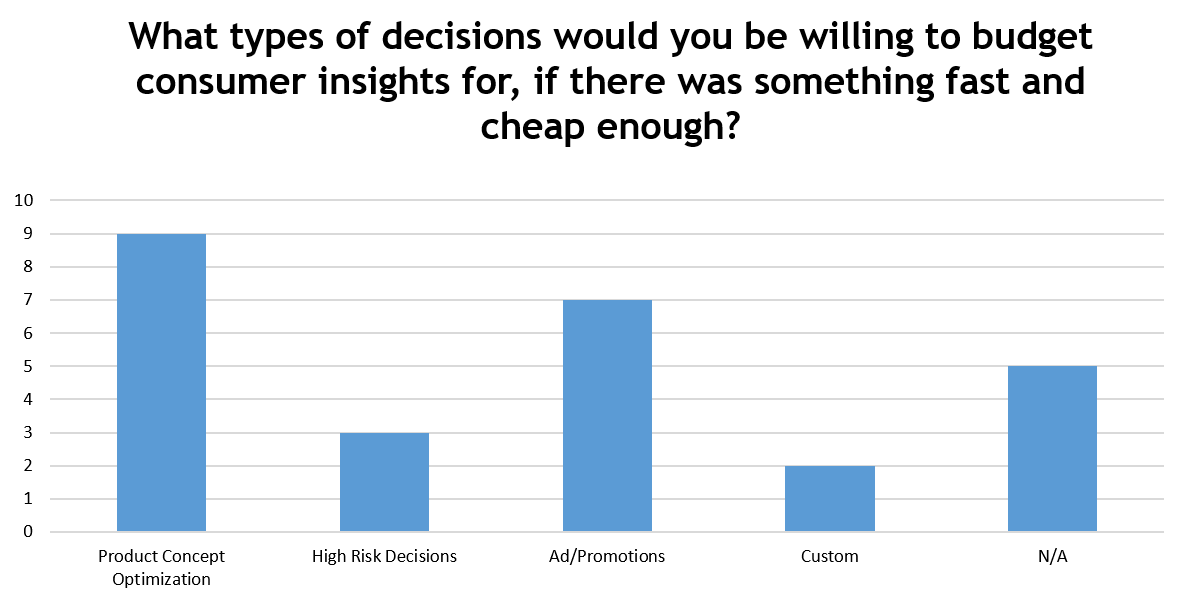

We asked our panel about the types of consumer insights they would be willing to budget for, provided there were sufficient resources. The top choices were Product Concept Optimization and testing Ad Campaigns/Promotions.

Budgeting and choosing the right tools for these tests is critical. Returning back to that “good enough” theme on Product Concept Optimization, Kathryn Korostoff’s 2010 post on product testing is still relevant.

Korostoff, of Research Rockstar, wrote about the seeking balance in product and pricing research. Obviously, you need to hear from your target market, especially as more marketing is based on those “downstream” decisions that was described by Niraj Dawar earlier in the post.

The respondents want to know how people feel about product concepts, or new ad campaigns. They definitely want to mitigate those high-risk decisions.

But Korostoff notes that it’s critical to avoid too much analysis.

“But I have seen companies completely miss windows of opportunity because they kept adding on less-than-critical features before they would launch. Kept conducting more and more research to inform (or justify) their decisions.”

Sometimes imperfect data versus no data is preferable. “And sometimes, directional data sooner is better than quantitative data later. In any case, knowing when to stop conducting market research in order to price and release new products can be tricky.”

What We Learned...and Why We Learned It

No market research is conducted without a specific purpose in mind. Our Digsite was conducted to gain insight into the top priorities for marketing managers. The top priorities include:

-

Provide “downstream” marketing data that can drive strategy

-

Help prioritize top tasks

-

Provide data analysis, but not so much that would result in paralysis

-

Find insights that fit within a cost-effective and time-effective window

To learn more about how your company can benefit from iterative research, check out our Digsite Fact Sheet!